Recently I attended a lunch where we were all asked to present something provocative/mind-blowing. I thought about that for a while and realized that I want my provocative thought to not be something that is a pie in the sky idea but instead something that is based on a series of logical conclusions. Well, here is a series of logical progressions that lead me to believe that in the near future, we will see the emergence of a new class of company.

Today we have only two types of companies. Private companies, which have a closed shareholder base, and typically no active market for the stock, or, public companies, where they have a open shareholder base and an active market for the stock of the company. Of course public markets come with a fair amount of regulation as well. One of the advantages of being a private company is not being required to comply with a large number of rules and regulations that apply to public companies.

But, things are changing. Some of these changes have already happened, and others are well under way.

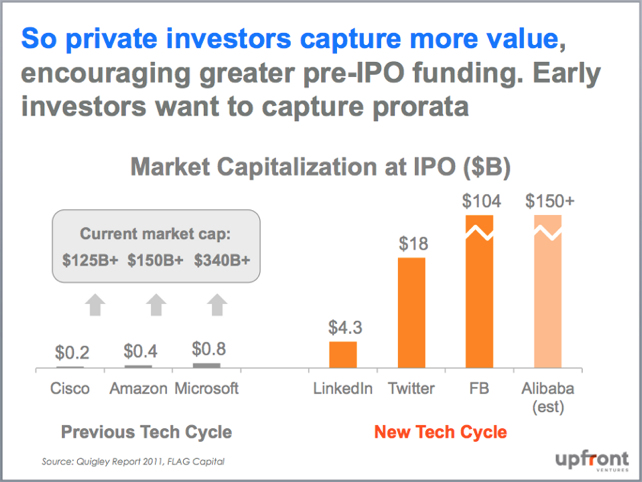

1) Value creation has shifted to private companies: When Microsoft, Apple, or Amazon, went public, these companies were valued in the hundreds of millions of dollars. These companies continued to grow as public companies and added hundreds of billions of dollars of value in public markets. This meant that anyone who was smart / lucky enough to buy stock in these companies when they went public and hold that stock, participated in the value created by these companies and benefitted from it.

However, if you look at Facebook, Twitter, Snapchat or other companies that went public in recent years, these were already multi-billion dollar companies at the time of going public. A very large portion of the value creation in these companies happened while they were still privately held companies. This means that a smaller group of typically accredited investors could partake in the value creation of these companies during their years as a privately held company.

This slide borrowed from Mark Suster’s blog post on The Changing Structure of the VC Industry illustrates the same point nicely:

2) New money is entering private markets: Earlier companies like Fidelity, T. Rowe Price, etc. would wait till a companies IPO and buy stock in the IPO. Today all of these companies have realized that they cannot wait to buy the stock of these companies in public markets as they want to partake in the value creation that happens in private markets. It follows then that a lot of the capital that was previously only available to public companies has shifted to invest in these companies while they are still private. Or in other words, there is more capital entering private markets that there was ever before.

3) Companies will stay private longer: If companies do not need to access the public markets in order to access capital and are able to secure billions of dollars of capital in private markets, then they have a lowered sense of urgency to go public. Why deal with all the hassles of public markets when there is sufficient capital accessible as a private company that doesn’t have to take on a much higher regulatory burden?

4) A need for liquidity: Companies end up staying private longer. The average time to IPO is increasing and has now crossed 8–9 years and is approaching 10 years. However, companies are still issuing options with 4 year vesting cycles. Founders, employees, and early investors have lives to lead (getting married, buying houses, having kids) and funds to return (most venture funds have a 10+2 year cycle and need to provide liquidity for their LPs at the end of the life of the fund). This then means that if companies are going to stay private for a really long time (8–10 years) then there has to be a relief valve for the liquidity needs of the early shareholders. The logical conclusion is that this has and will continue to lead to more secondary transactions in private markets.

5) A need for transparency: Most secondary transactions that are occurring are happening with very little information being made available to buyers and a lack of market efficiency for sellers. This is where I start to speculate a bit, that if we continue to see an increase in secondary transactions, then there will also be an increased need for transparency by these companies.

6) SEC oversight and regulation: The distinction between public companies and private companies has been very binary so far. I postulate that in the near future, we will see the emergence of a new class of company — one that is a privately held company, with a high valuation/market capitalization, and an active/regular secondary market for its stock.

Such a company would probably be asked to comply with a new/different set of rules and regulations than what exist today. The binary distinction of a private vs. public company is not going to be sufficient to capture the need for transparency and the fact that such a company will have an active/regular secondary market (albeit not publicly traded) will/should invite additional scrutiny and regulation.

This transitional class of company (a privately-traded company) can be viewed as a semi-private or semi-public company. If such a class of company dos exist in the future, it could further elongate the amount of time before companies enter the public phase of their existence.

TL;DR (yes, I know it’s supposed to be at the beginning, but I really did want you to read the thinking behind it first): In the near future, we will see three types of companies: a privately-held company, a privately-traded company (which have high valuations and an active secondary market), and a public companies.